Wealth Management Things To Know Before You Buy

Facts About Wealth Management Uncovered

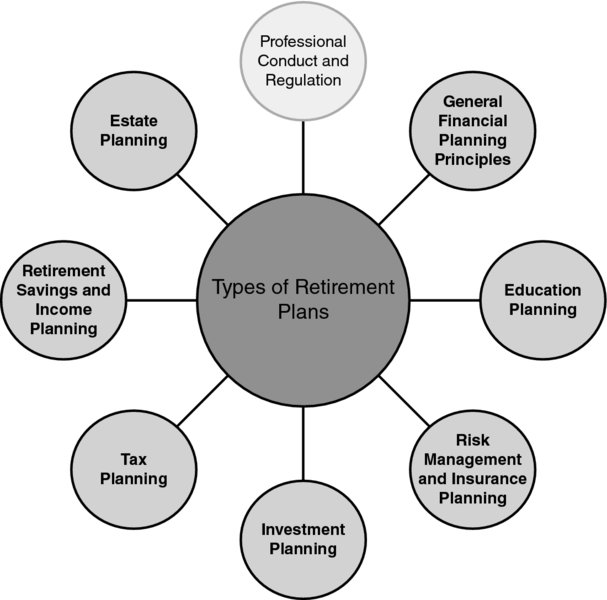

Table of ContentsSome Known Questions About Wealth Management.An Unbiased View of Wealth ManagementHow Wealth Management can Save You Time, Stress, and Money.About Wealth ManagementWhat Does Wealth Management Mean?

The non-financial aspects include way of life options such as just how to hang around in retired life, where to live, and when to give up functioning altogether, among various other points. An alternative strategy to retirement planning takes into consideration all these locations. The emphasis that a person places on retired life preparation changes at different stages of life.

Others say most retired people aren't conserving anywhere near adequate to fulfill those benchmarks as well as need to adjust their lifestyle to live on what they have. While the amount of money you'll wish to have in your savings is necessary, it's additionally a great concept to take into consideration every one of your expenses.

See This Report on Wealth Management

And since you'll have extra spare time on your hands, you may likewise wish to element in the price of enjoyment and traveling. While it may be difficult to find up with concrete numbers, be certain to come up with a sensible price quote so there are no shocks in the future.

No matter where you are in life, there are numerous key steps that relate to nearly every person during their retired life planning. The adhering to are a few of the most typical: Develop a strategy. This includes making a decision when you intend to start saving, when you wish to retire, and also just how much you wish to save for your ultimate objective.

Examine on your financial investments from time to time and make periodic adjustments. Retired life accounts come in several forms as well as sizes.

You can and should add more than the quantity that will certainly earn the company match. Some professionals suggest upwards of 10%. For the 2023 tax obligation year, individuals under age 50 can add as much as $22,500 of their revenues to a 401( k) or 403( b) (up from $20,500 for 2022), several of which might be furthermore matched by a company. wealth management.

All about Wealth Management

This implies that the cash you save is deducted from your income prior to your taxes are taken out. It decreases your taxable income and also, therefore, your tax obligation.

When it comes time to take distributions from the account, you are subject to your common tax obligation price at that time. Keep in mind, however, that the cash expands on a tax-deferred basis. There are no resources gains or returns taxes that are evaluated on the balance of your account until you start making withdrawals.

Roth IRAs have some limitations. The payment restriction for either IRA (Roth or standard) is $6,500 a year, or $7,500 if you are over age 50. Still, a Roth has some earnings limits: A solitary filer can add the full amount just if they make $129,000 or much less each year, since the 2022 tax year, and $138,000 in 2023.

Little Known Questions About Wealth Management.

It functions the exact same means a 401( k) does, enabling employees to conserve money instantly with payroll reductions with the choice of an employer match. This quantity is capped at 3% of a staff member's yearly income.

Catch-up contributions of $3,500 allow employees 50 or older learn the facts here now to bump that limitation up to $19,000. When you established up a retired life account, the concern comes to be just how to route the funds.

Below are some standards for effective retirement planning at different stages of your life. Those starting adult life may not have a great deal of money complimentary to spend, yet they do have time to allow financial investments mature, which is an essential as well as beneficial piece of retired life savings. This is as a result of the principle of intensifying.

Also if you can just place aside $50 a month, it will be worth 3 times extra if you invest it at age 25 than if you wait to start spending till age 45, thanks to the delights of intensifying. You may be able to invest more money in the future, however you'll never ever have the ability to make up for any type of lost time.

The 4-Minute Rule for Wealth Management

It's crucial to continue saving at this stage of retirement planning. The combination of earning even more money and the time you still need to spend as well as earn passion makes these years a few of the ideal for aggressive financial savings. People at this click phase of retirement preparation should remain to take benefit of any 401( k) coordinating programs that their companies offer.